Ultimate Guide to Financial Advisor Business Plans

Creating a financial advisor business plan can help you map out a clear strategy for reaching your goals. Proper planning is essential, whether you’re establishing a new advisory firm or attempting to scale an existing business. If you’re drafting a business plan for the first time, it’s important to understand what elements to include and how to make your plan work for you.

Are you looking to expand the marketing of your financial advisor practice? Try SmartAsset AMP, a holistic client prospecting and marketing automation platform.

Why Financial Advisors Need a Business Plan

It’s absolutely possible to launch or grow an advisory business without having a firm business plan in place. However, you could potentially be hindering your success if you’re moving ahead without one.

What can a financial advisor or wealth management business plan do for you? In simple terms, a business plan allows you to create an organized strategy for starting and growing your firm. That includes identifying what your mission is for the business, your main objectives and the action steps that you’ll need to take to reach them.

Business planning is something financial advisors may neglect because they assume that it’s too time-consuming or that they don’t need a defined plan. Creating a business plan is not as difficult as it might seem. Moreover, just because you don’t immediately see the need for a plan doesn’t mean that it isn’t there.

For example, any of these signs could suggest that a business plan is exactly what your firm needs:

- You have lots of ideas about what you could do to grow your business but never act on them.

- Alternately, you tend to start projects without completing them, or quickly jump from one project to another.

- Among your staff, morale is low while frustration is high.

- You’ve set clear goals but never seem to make significant progress toward any of them.

- The numbers show that your business is stagnating, or worse, moving backward.

Implementing a business plan could be exactly what you need to start reversing some of those negative trends. Looking at your business with a critical eye can help you pinpoint areas for improvement, which can make it easier to define what belongs in your plan.

Key Elements of a Financial Advisor Business Plan

A business plan for a financial advisor typically follows the same format as the plan for any other type of business. If you’ve never written a business plan before, here are nine things you’ll need to include:

- Executive summary: Your executive summary is essentially an introduction to your business and your plan. In this section, you’ll outline your company mission and vision statement. An executive summary may also include a brief financial summary and projections for expected growth over the next three to five years.

- Company overview: The next section in your financial advisor business plan should detail your company background, including when it was founded and how it’s structured. You may also include information about your startup costs and how much capital you raised from outside investors.

- Industry analysis: The industry or market analysis section offers an overview of the market that you’re in. Here, you’ll cover market trends, industry growth forecasts and who your business’s main competitors are within your niche.

- Customer analysis: The next section of your business plan should outline who your ideal customers are and how you intend to serve them. If you have not yet created an ideal customer profile or identified a specific niche that you plan to target, that’s something you’ll likely want to give some thought to in order to make sure that your business plan is truly speaking to your objectives.

- Competitive analysis: You may have briefly identified your competitors in the industry analysis section, but you can dive deeper into who they are here. That can include direct competition, such as other advisory firms, and indirect competitors, such as robo-advisor platforms. The goal of this section is to clarify how your business stands out and what you plan to do to maintain your place in the market.

- Marketing plan: Marketing is something you might spend a sizable part of each day doing, especially if you’re trying to attract new clients. The marketing section of a financial advisor business plan should detail specific strategies that you plan to use to increase visibility. For example, that might include digital content marketing or email marketing. You may also use an online lead generation tool like SmartAsset AMP to grow your customer base and save time. This end-to-end marketing solution can help you find potential clients and automate your nurture campaigns.

- Operations plan: Your operations plan refers to the steps you’ll take to achieve the goals you’ve set for your advisory business. It includes both the day-to-day actions you’ll need to take to keep the business running, as well as the strategies you’ll implement to achieve longer-term objectives.

- Management team: This section is where you’ll expand on the education and background of your management team. If members of management have any specific achievements you’d like to highlight, you can call those out here.

- Financial plan: The financial section of an advisory business plan is where you’ll set expectations for growth and break out the costs of running the business. If you plan to seek financing for your business at any point, it’s important to make sure this section is as detailed as possible. Lenders or investors may also expect to see income statements, cash flow statements or a balance sheet accompanying this section.

Tips for Writing a Financial Advisor Business Plan

Knowing what to include in a business plan is important, as each of the sections outlined above serves a specific purpose. Beyond that, it helps to give some thought to what you hope to get out of writing the plan and what makes your business unique.

Here are five common tips for creating an effective financial advisor or financial planner business plan:

- Clarify your vision: Before you start writing your plan, ask yourself what the bigger picture looks like. Where do you want your business to be five, 10 or 20 years from now? What is its purpose for existing? Answering those kinds of questions can help you to define your mission statement and fill in the blanks for the rest of your plan.

- Define your goals and objectives: Once you have a vision in place, the next step is figuring out what you’ll need to do to realize it. This is where it’s important to outline detailed goals for the near and future term. When creating goals, it’s helpful to make them specific and measurable, so you can track your progress. Setting clear deadlines is also important for staying on track to meet them.

- Prioritize and delegate: Trying to do everything at once can be a recipe for failure if you’re stretching yourself too thin. Once you have the big-picture plan fleshed out, consider what actions or goals take priority and who among your staff will be responsible for working toward them. If you’re a one-person operation, consider how you can outsource tasks so that you’re able to focus on your most important activities.

- Measure your progress: Tracking your progress toward your goals can help you see whether you’re moving forward and if not, what you might need to do to change course. Establishing benchmarks or indicators makes it easier to measure what’s working and what’s not.

- Review your plan: Writing a business plan is not a one-and-done endeavor. Revisiting your plan regularly is a good opportunity to adjust if needed and set new goals. How often you decide to do that is up to you, but it may be helpful to review your plan quarterly, biannually or annually, depending on the type of goals you’ve set for yourself.

Bottom Line

Whether you’re starting a brand-new business or you run an established firm, there are some definite advantages to creating a business plan. The more time you invest in planning, the bigger the payoff may be as you work toward your growth targets.

Tips for Growing Your Advisory Business

- SmartAsset AMP (Advisor Marketing Platform) is a holistic marketing service financial advisors can use for client lead generation and automated marketing. Sign up for a free demo to explore how SmartAsset AMP can help you expand your practice’s marketing operation. Get started today.

- Another way to grow your client base is by expanding your radius. Clients are increasingly willing to work with financial advisors remotely. Consider broadening your search and working with high-net-worth investors who are comfortable connecting online, rather than in person.

Photo credit: ©iStock.com/ LaylaBird , ©iStock.com/ Weedezign , ©iStock.com/ Morsa Images

Rebecca Lake, CEPF®Rebecca Lake is a retirement, investing and estate planning expert who has been writing about personal finance for a decade. Her expertise in the finance niche also extends to home buying, credit cards, banking and small business. She's worked directly with several major financial and insurance brands, including Citibank, Discover and AIG and her writing has appeared online at U.S. News and World Report, CreditCards.com and Investopedia. Rebecca is a graduate of the University of South Carolina and she also attended Charleston Southern University as a graduate student. Originally from central Virginia, she now lives on the North Carolina coast along with her two children. Rebecca also holds the Certified Educator in Personal Finance (CEPF®) designation.

Read More About Advisor Resources

Compliance & Legal

Potential Consequences of Breaching Fiduciary Duty

June 25, 2024 Read More

LinkedIn Lead Generation Strategies for Financial Advisors

June 28, 2024 Read More

Professional Development

How to Become a Fiduciary Advisor

June 6, 2024 Read More

Client Acquisition

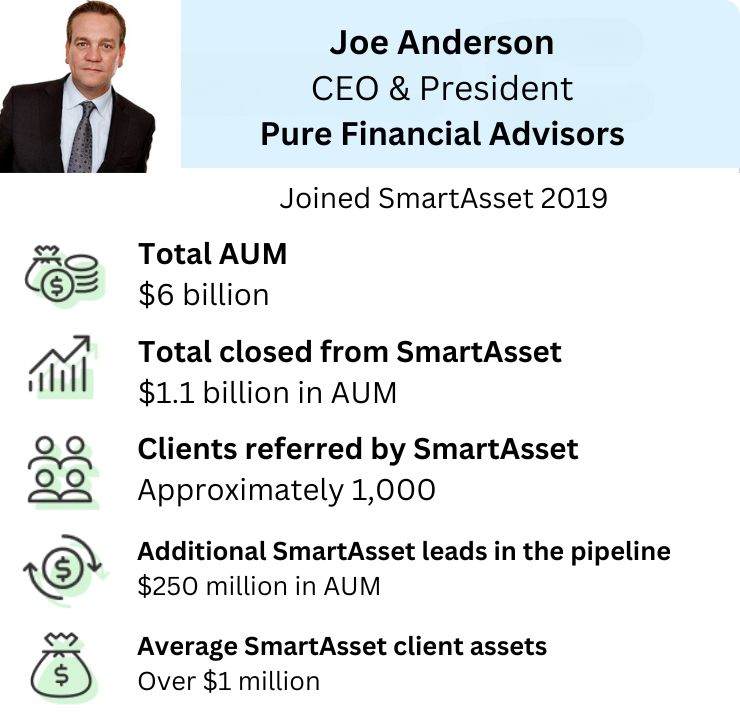

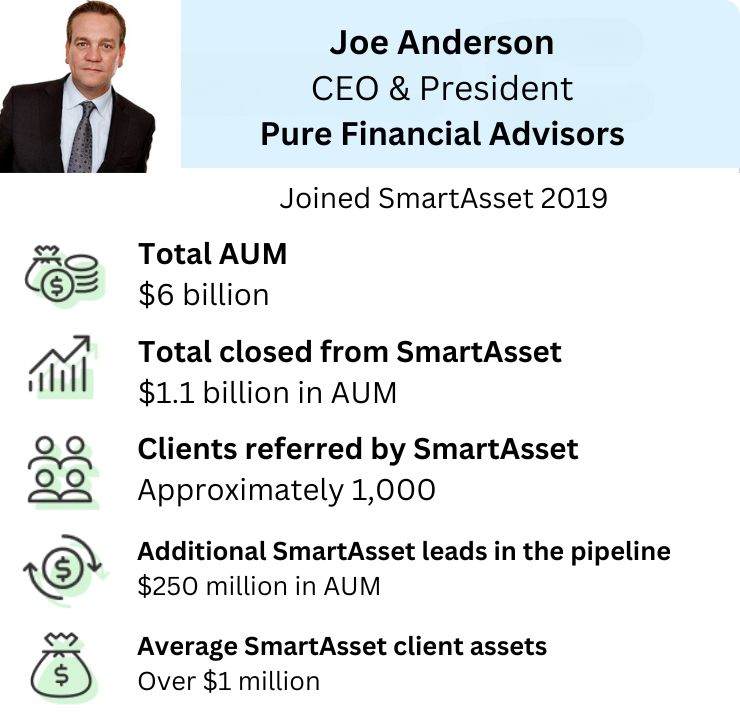

Pure Financial Advisors, LLC Reports an Added $1 Billion in .

May 21, 2024 Read More

More from SmartAsset

- Compare Up to 3 Financial Advisors Near You

- Mortgage Calculator

- How Much Do I Need to Save for Retirement?

- Calculate Your Capital Gains Tax

- Should I Refinance My Mortgage?

- Compare Mortgage Rates

Subscribe to our Newsletter

Join 200,000+ other subscribers Subscribe

Get in touch

SmartAsset

Get Social

Legal Stuff

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. SmartAsset's services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. SmartAsset receives compensation from Advisers for our services. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any user's account by an Adviser or provide advice regarding specific investments.

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors.

This is not an offer to buy or sell any security or interest. All investing involves risk, including loss of principal. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.